Managing money can feel overwhelming, especially for beginners, but budgeting is the key to success. Whether you’re saving money for a rainy day, cutting unnecessary expenses, or planning for a big purchase, starting with the right budgeting categories is essential. This guide will walk you through the best budgeting categories for beginners, helping you take control of your finances, track your spending, and reach your money goals efficiently.

What is Budgeting and Why is it Important?

Budgeting is the process of creating a plan for how you will spend your money. This spending plan, also known as a budget, allows you to allocate your income towards essential expenses, savings, and other financial goals. For beginners, budgeting is a crucial step toward financial literacy and independence. It helps you understand where your money is going, ensuring that you live within your means while saving for future expenses.

Without a solid budget, it’s easy to overspend, accumulate debt, and neglect savings. On the flip side, a well-organized budget leads to financial confidence, empowers you to make informed decisions, and offers peace of mind. By establishing and maintaining a budget, you can avoid financial pitfalls, save money more effectively, and even discover opportunities for investing in your future.

The Core Principles of Budgeting

Before diving into the specific budgeting categories, it’s essential to understand a few core principles of budgeting:

- Track Every Dollar: Every dollar you earn should have a purpose in your budget, whether it goes toward bills, savings, or entertainment.

- Pay Yourself First: Prioritize saving money by allocating a portion of your income towards savings before paying for other expenses.

- Set Realistic Goals: Whether saving money for an emergency fund, a vacation, or retirement, set achievable financial goals that fit within your budget.

- Be Flexible: Life is unpredictable, so your budget should have some flexibility to accommodate unexpected expenses without derailing your financial plans.

Best Budgeting Categories for Beginners

When creating a budget for the first time, it’s essential to break down your expenses into meaningful categories. This ensures that your budget is both organized and comprehensive, allowing you to easily track how much you’re spending and saving money in each area of your life. Below are the most important budgeting categories for beginners:

Housing

For most people, housing is their largest expense. This category includes your rent or mortgage payments, property taxes, insurance, and any maintenance or repairs. For renters, utilities like water and trash collection might also be included in your rent. As a beginner, aim to allocate no more than 30% of your income towards housing.

Transportation

Transportation is the second-largest expense for many people. This category includes car payments, fuel, insurance, public transportation fares, and any maintenance costs like oil changes or tire rotations. Budgeting for transportation ensures you have enough set aside to keep moving without unexpected breakdowns or issues.

Groceries and Dining Out

Food is an essential part of any budget, and it’s important to differentiate between groceries and dining out. Groceries typically include food and household items, while dining out covers restaurant meals, coffee runs, and takeout. Beginners often overspend in this area, so monitoring how much you’re spending on food is key to saving money. Consider meal planning to cut costs on dining out and groceries.

Savings

A vital component of every budget is savings. Whether it’s an emergency fund, retirement savings, or saving for a big purchase, this category should be a priority. Beginners often overlook the importance of saving money, but it’s one of the most important aspects of financial health. Try to allocate at least 20% of your income towards savings to build a solid financial cushion.

Debt Repayment

If you have any outstanding debts, such as student loans, credit card debt, or a car loan, this category will help you allocate funds towards paying them off. Prioritizing high-interest debts, like credit cards, can save you money in the long run, while also helping you reduce financial stress. Make sure to budget for at least the minimum payment required on all debts, but aim to pay more to eliminate debt faster.

Utilities

Utilities include essential services like electricity, water, gas, internet, and phone bills. For beginners, it’s easy to overlook these small recurring expenses, but failing to budget for them can result in unexpected shortfalls. Make sure to review your past bills to create an accurate estimate of your monthly utility costs.

Insurance

Insurance is often a forgotten expense, but it’s a critical part of your budget. This category includes health, dental, life, auto, and home insurance policies. Having adequate insurance protects you from unexpected financial burdens due to accidents, illness, or natural disasters. Always review your coverage annually to ensure you’re getting the best deal.

Entertainment and Leisure

While saving money and paying off debt are priorities, life isn’t all about work and bills. Entertainment and leisure activities should also have a place in your budget. Whether it’s movie nights, hobbies, or vacations, allocate a small portion of your income for fun. This will help you maintain balance and prevent burnout, making it easier to stick to your budget in the long run.

Personal Care

This category includes expenses related to grooming, health, and well-being. Think haircuts, skincare products, gym memberships, and medical expenses that aren’t covered by insurance. Budgeting for personal care is important because these costs can add up over time, but are often forgotten when planning finances.

Miscellaneous Expenses

Life throws curveballs, and unexpected expenses are inevitable. The miscellaneous category covers all the small, unplanned purchases that pop up, such as gifts, home repairs, or medical bills. Setting aside a small amount of money in this category will help you stay prepared for these random costs without derailing your entire budget.

Charitable Giving

If you donate to charitable causes or regularly contribute to a religious organization, this should be part of your budget. Allocating money for giving ensures that you can consistently support the causes you care about without negatively impacting your other financial goals.

Emergency Fund

While it might fall under savings, an emergency fund deserves its own category in your budget. This is money set aside specifically for unexpected events, such as job loss, medical emergencies, or urgent car repairs. Experts recommend saving at least 3-6 months’ worth of living expenses in your emergency fund to provide a financial safety net.

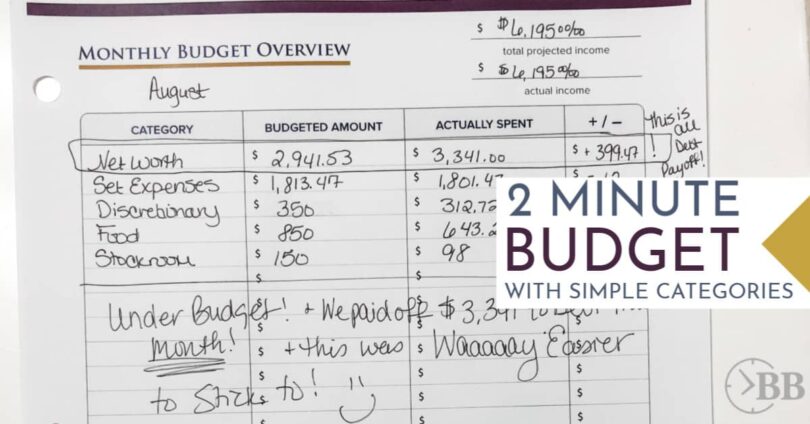

How to Get Started with Your Budget

Now that you know the best budgeting categories for beginners, it’s time to create your own budget. Here’s a simple step-by-step guide to help you get started:

- Track Your Income: Start by calculating your total income. This includes your salary, side gigs, and any other sources of regular income.

- List Your Expenses: Write down all of your monthly expenses using the categories above. Be as detailed as possible, including everything from rent to entertainment.

- Assign Percentages: Allocate percentages of your income to each category. Use general budgeting rules like the 50/30/20 rule, where 50% of your income goes to needs (housing, food), 30% to wants (entertainment, dining out), and 20% to savings and debt repayment.

- Track and Adjust: Keep track of your spending each month to see if you’re sticking to your budget. If necessary, adjust your categories or spending habits to better meet your financial goals.

Budgeting Tips for Beginners

- Automate Savings: Set up automatic transfers to your savings account to ensure you’re consistently saving money without thinking about it.

- Use Budgeting Apps: There are many free budgeting apps available that can help you track your spending and make adjustments as needed.

- Stay Flexible: As you get more comfortable with budgeting, don’t be afraid to make changes. Your priorities and expenses will shift over time, and your budget should reflect that.

- Start Small: If you’re feeling overwhelmed, start with a few basic categories and gradually add more as you become more confident in your budgeting skills.

Conclusion

Starting a budget may seem daunting at first, but by using these best budgeting categories for beginners, you can gain control over your finances and start saving money. Whether you’re saving for a big purchase, paying off debt, or simply trying to get better at managing money, a well-organized budget is your roadmap to success. By tracking your income and expenses, setting financial goals, and adjusting as needed, you’ll be on your way to financial freedom in no time.

Frequently Asked Questions

What percentage of my income should go to savings?

A good rule of thumb is to save at least 20% of your income. This can go toward an emergency fund, retirement, or other savings goals.

How do I make sure I stick to my budget?

Track your spending regularly, use budgeting apps, and review your financial goals each month to stay on track. Building a habit of reviewing your budget can help you stick with it long-term.

What should I do if I overspend in a category?

If you overspend in one category, try to make adjustments in another to balance it out. Flexibility is key to maintaining a healthy budget.

How can I save money on groceries?

Meal planning, using coupons, buying in bulk, and shopping during sales can help reduce your grocery bill significantly.

Do I need to budget for insurance?

Yes, insurance is a crucial expense that protects you from financial disasters. Always budget for your insurance premiums and review them annually to ensure you’re getting the best rate.

What’s the difference between an emergency fund and savings?

An emergency fund is money set aside specifically for unexpected expenses, while general savings can be for future purchases, vacations, or retirement.

Leave a Comment